Hello everyone, I hope your having a great summer. I also hope you received lots of dividends in August. I booked this final week of August off which is allowing me to write this early, as you know I usually don’t publish these posts until a couple weeks into a new month. On a happy note for labour day weekend ( 2 days) I am going to be travelling to Pittsburgh for the weekend to watch the Blue Jays play. Really looking forward to the trip.

This month was a very good and quiet month when it comes to investing for me. Quiet in the sense that only 8 stocks paid me this month. Also quiet being I didn’t add any capital and buy stocks. My income for August came in at $571.34 which is a 33.7% increase when compared to last August. Here is the income per account:

- TFSA $288.45

- RRSP $282.89

If you’re new to my site my TFSA has all Canadian stocks and my RRSP is made up of one Canadian stock and the rest US stocks. That being said the majority of the dividend income in my RRSP is in US dollars. For simplicity for the site I just mark all the income as Canadian.

Tax Free Savings Account (TFSA)

| 2021 | 2022 | |

| Bank of Montreal | $61.48 | $147.28 |

| Royal Bank of Canada | $49.01 | $119.53 |

| Emera | $11.48 | $21.64 |

| The Keg Royalties Income Fund | $21.49 | |

| iShares S&P/TSX Capped REIT Index ETF | $33.30 | |

| Total | $176.76 | $288.45 |

The reason for the big income growth this month comes from my two big Canadian banks. I love my Canadian banks lol.

Registered Retirement Savings Plan (RRSP)

| 2021 | 2022 | |

| AbbVie | $101.40 | $112.03 |

| Verizon | $50.20 | $61.63 |

| General Dynamics | $47.60 | $50.67 |

| Texas Instruments | $39.78 | $45.15 |

| Apple | $11.44 | $13.41 |

| Total | $250.42 | $282.89 |

Except for Verizon the growth for all the stocks were from dividend increases and dripping new shares when the company paid their quarterly dividends.

Dividend Reinvestment Plan (DRIP)

| # Of Shares | Forward Income | |

| Verizon | 1.343 | $3.44 |

| Bank of Montreal | 1.1573 | $6.43 |

| Royal Bank of Canada | 0.9529 | $4.88 |

| AbbVie | 0.7866 | $4.44 |

| Emera | 0.3478 | $0.92 |

| Texas Instruments | 0.2513 | $1.15 |

| General Dynamics | 0.2224 | $1.12 |

| Apple | 0.0779 | $0.07 |

| Total | 5.1392 | $22.45 |

The share count isn’t all that high this month, however all the stocks pay a nice dividend so my forward income received a nice boost.

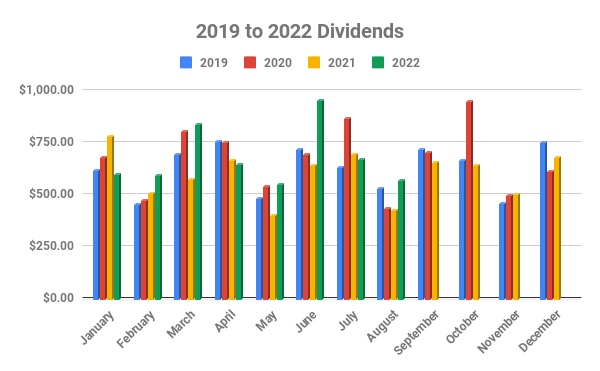

Month to Month Dividends

Dividends Received Per Year

Here is a list of all the dividends I’ve received since I started investing in stocks. So far I have received $45,602.47

2022 Dividend Goal

I’m just $3,072.25 away from reaching my goal.

Stock Purchases

There were no purchases this month, I’m not sure about September either. I maybe walking the picket line in September or October so I will need to save cash.

Dividend Increases

Received two raises this month from Equitable Bank and Altria Group. This was Equitable Bank third raise of the year, so happy I doubled my position in the company at the beginning of the year. I will probably buy more when I get more TFSA contribution room on January 1st.

- Equitable Bank raised their dividend 7% to $0.31 per share quarterly up from $0.29

- Altria Group raised their dividend 4.4% to $0.94 per share quarterly up from $0.90

Here is the list of dividend increases I’ve received so far in 2022.

| Stock | Old Dividend | New Dividend | Forward Income |

| Canadian National Railway | $0.5750 | $0.7325 | $34.28 |

| BCE | $0.875 | $0.92 | $17.52 |

| Brookfield Renewable Partners Corporation | $0.30375 | $0.32 | $9.44 |

| Equitable Bank | $0.185 | $0.28 | $26.60 |

| 3M Company | $1.48 | $1.49 | $0.80 |

| TC Energy | $0.87 | $0.90 | $9.16 |

| Go Easy | $0.66 | $0.91 | $35.00 |

| Home Depot | $1.65 | $1.90 | $23.00 |

| Aecon | $0.175 | $0.185 | $6.20 |

| General Dynamics | $1.19 | $1.26 | $11.20 |

| Johnson & Johnson | $1.06 | $1.13 | $11.28 |

| Apple | $0.22 | $0.23 | $2.20 |

| Telus | $0.3274 | $0.3386 | $10.76 |

| Equitable Bank | $0.28 | $0.29 | $2.80 |

| Algonquin Power & Utilities | $0.1706 | $0.1808 | $21.83 |

| Bank of Montreal | $1.33 | $1.39 | $25.20 |

| Royal Bank of Canada | $1.20 | $1.28 | $29.88 |

| Walgreens Boots Alliance | $0.4775 | $0.48 | $0.51 |

| Equitable Bank | $0.29 | $0.31 | $1.41 |

| Altria Group | $0.90 | $0.94 | $23.90 |

| Total | $302.97 |

With the Altria raise I have crossed the $300 mark in forward income, I’m hoping to reach $500 by the end of the year. I have several big names that announce raises in the Sept to December timeframe so fingers crossed.

Thanks for reading!

Matthew

Hi Matthew. great article. I have one quick question for you as I saw you were able to purchase fraction of stocks on your DRIP program.

Which trading platform are you using?

Thanks

LikeLike

Hi Raj, thanks i use WealthSimple Trade platform for my accounts. All of my stocks except two offered fractional shares.

LikeLike

great stuff Matt

hope you enjoyed Pittsburgh, good series for the jays

keep it up

LikeLiked by 1 person

Thanks Rob! Trip was amazing!

LikeLike

Great detailed report. Can’t wait to see you reaching the $8500 goal for 2022.

https://vibrantdreamer.com/combined-canadian-dividend-income-august-2022/ is where I am including yours and everyone else as always (Sorry for the delay as I was traveling, again!)

LikeLike

Thank you! I have to work on my September post soon. I should be close to my goal this year. Thanks for reading and thanks for including me in your post.

LikeLike

[…] Matthew @ All About Dividends earned $571.34 in dividends which is a 33.7% YoY growth. His payers were $BMO, $RY, and $EMA in TFSA while he got paid from AbbVie, Verizon, General Dynamics, Texas Instruments, and Apple in RRSP. […]

LikeLike