Hey everyone how are you? I hope you all had a fantastic month of October and collected lots of dividends from your investments. Today I am going to look back and share with you my October. Last month was pretty darn good one. On the 15th my 2019 dividend income surpassed my 2018 income two and a half months early. I’m excited to see where I end up by the end of the year.

For October I received payments from 18 stocks and 1 ETF, from these I received a total of $669.14 a new October high for me. I have three investment accounts and the income breakdown is as follows:

- RRSP $386.45

- TFSA $279.13

- LIRA $3.56

I had three US stocks pay me so here is the currency that I received the dividends in. Just a reminder to keep things simple I report the US currency as Canadian that way I don’t have to convert it to Canadian.

- USD $107.03

- CDN $562.11

RRSP

| 2018 | 2019 | |

| BCE | $103.44 | $110.95 |

| TC Energy | $71.76 | $109.50 |

| Telus | $53.55 | $58.50 |

| Altria Group | $51.24 | |

| Algonquin Power & Utilities | $52.52 | $45.12 |

| Realty Income Corp | $13.43 | $10.67 |

| North West Company | $0.32 | $0.33 |

| Leon’s Furniture | $0.14 | $0.14 |

| BMO International Dividend ETF | $22.23 | |

| BMO US Dividend ETF | $32.09 | |

| Total | $349.48 | $386.45 |

New investments in Altria and TC Energy helped me offset the loss of the two ETFs. Another key to my growth this month was dividend increases from BCE, Telus, and TC Energy.

TFSA

| 2018 | 2019 | |

| Bank of Nova Scotia | $93.60 | |

| BMO International ETF | $38.79 | |

| Inter Pipeline | $33.32 | $34.77 |

| The Keg Royalties Income Fund | $28.10 | $28.66 |

| Plaza Retail REIT | $24.22 | $24.85 |

| Transcontinental | $24.20 | |

| Chorus Aviation | $17.88 | $18.32 |

| Canadian Apartment Properties REIT | $9.20 | $9.55 |

| European Residential REIT | $3.94 | |

| Andrew Peller Ltd | $2.42 | |

| Artis REIT | $14.67 | |

| Boston Pizza Royalties Fund | $12.31 | |

| ZCL Composites Inc | $30.65 | |

| Total | $170.35 | $279.13 |

New investments are the key to the growth here, as you can see I received payments from five stocks that I didn’t have last October.

LIRA

| 2018 | 2019 | |

| Diversified Royalty Corp | $3.56 | |

| Enbridge Income Fund | $26.55 | |

| Total | $26.55 | $3.56 |

All quiet here, not too much going on with this account.

DRIP

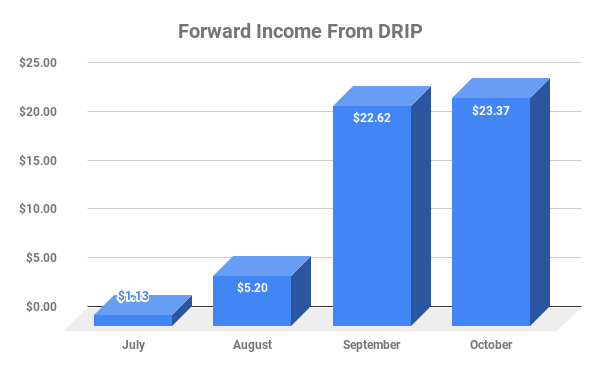

October turned out to be another great month for me, I was able to drip a large amount of new shares that will help fuel my dividend growth.

| # Of Shares | Forward Income | |

| Plaza Retail REIT | 5 | $1.40 |

| Algonquin Power & Utilities | 3 | $1.69 |

| Chorus Aviation | 2 | $0.96 |

| Telus | 1 | $2.25 |

| Altria Group | 1 | $3.36 |

| Inter Pipeline | 1 | $1.71 |

| BCE | 1 | $3.17 |

| Transcontinental | 1 | $0.88 |

| Bank of Nova Scotia | 1 | $3.60 |

| TC Energy | 1 | $3.00 |

| The Keg Royalties Income Fund | 1 | $1.13 |

| Diversified Royalty Corp | 1 | $0.22 |

| Total | 19 | $23.37 |

I bet last month’s total lol. I can see a trend I will be having one slow month followed by two great months. After a couple of years I’m looking forward to seeing what this chart will show. Do you guys drip your shares or take cash?

2016 To 2019 Dividends

Dividend Goal 2019

As mentioned above on October 15th my 2019 income surpassed my entire 2018 total. My goal for this year was $8,000 and over the next two months I’m predicting I will receive between $1,100 – $1,300 so I will fall just a little short but that’s ok. I believe this year has been very successful.

Stock Buys

I made two buys in the month, they were both stocks I already owned and wanted to add to my position.

- Suncor 28 shares

- Texas Instruments 13 shares

Dividend Increases

None that I am aware of this month.

Well everyone that does it for my monthly wrap up. I hope you all had a great month. Please feel free to let me know how you did in the comments below.

Matthew

Nice Matt.

A solid month of income with a tonne of drips. What’s not to like? Keep it up man

cheers

LikeLiked by 1 person

Thanks Rob, yup another solid month. I love seeing all those drips.

LikeLike

Congrats on a impressive month. Gotta love the DRIPS.

October was my best month ever!

LikeLiked by 1 person

Thanks and yes I certainly do love those drips. Congratulations on your record month

LikeLike

Looks good man! You should start posting your returns too..join the club man!

Man, our monthly incomes are always super close, within like 10-30 bucks usually..nice!

How come AQN went down from last year, even with drips and a divy increase? Did you sell some over the year?

All the best!

LikeLiked by 1 person

Hey Jordan thanks man. About posting my returns math isn’t my strong suit so I don’t really know how to calculate my returns. If I did it right I think my income grew 22%. Yes we are always so close to each other, let’s see how long we can continue that lol.

AQN is down only because I didn’t convert the dividend into CDN so the number you see $45 is USD. So if I converted it today it would be $59.47. I just figured to make it simple leave it in USD as it is in my US side of my RRSP.

LikeLike

Ahhh that makes sense regarding the conversion.

If everything you have is with RBC, they should give you your trailing 12 month, 3, 5 and since inception returns as well.

Anyways, keep rolling that divy snowball..it’s getting big fast!

LikeLiked by 1 person

Oh ok I will check out RBC about the trailing months you mentioned. I remember we did the annualized returns a little while ago. Thanks that divy snowball is going to start getting bigger with all our drips.

LikeLiked by 1 person

Well done Matt. Good to see the dividend income chugging along.

Best

R2R

LikeLiked by 1 person

Thank you sir! It’s slowly picking up steam now that I’m dripping shares. Congratulations to you on your excellent month.

LikeLike

Another solid month! Your TFSA is firing all cylinders.You have a great year behind you. You paid off debt, increased TFSA, avoided a strike! All good!

LikeLiked by 1 person

Thanks German, I am definitely having a pretty darn good year.

LikeLike

That’s a lot of DRiP shares, Matthew. Way to go! I reinvest my dividends as well.

Wow, that BNS addition in your TFSA was a real boost to this month’s income. BNS is the front runner there by a wide margin.

I agree, even if you end up short of the $8K dividend goal, you’ve had a great year. Keep up your tremendous efforts.

LikeLiked by 1 person

Thanks buddy! BNS was a great payer for me this month. In August I sold my Laurentian bank shares for more BNS, I thought it best to just stick with one bank in my TFSA account.

LikeLike

Congrats on the new October record. Always a good feeling reaching these milestones. Nice to see MO chipping in last month. That stock has been beaten down so hard it was too much to pass up. I added a lot over the last several months. Also nice seeing Canadian banks in the mix too. I like my TD, BNS and RY 🙂 Thanks for sharing.

LikeLiked by 1 person

Thanks Buddy, nice job on picking up MO it is beaten down. I was able to drip a new share. I also own BNS, RY.

LikeLike