Hello and welcome everyone, today I am going to share with you a change I have made to one of my investing accounts. Ever since I started investing I have always had my investments at one institution Royal Bank of Canada, however on January 30th I made the decision to move my Tax Free Savings Account to Wealthsimple Trade.

What Is Wealthsimple Trade?

Wealthsimple Trade (WS Trade) is a trading platform in Canada that offers zero commissions when you buy and sell stocks and ETFs. It is the first platform in Canada to offer this, other brokers usually charge $6.95 to $9.99 per trade. Also I should mention that Wealthsimple Trade is mobile only so now you can trade anywhere you are connected to the internet.

Some pros to this service are:

- Zero commissions

- buy small amounts of shares

Some cons to this service are:

- Not all accounts are available ( example LIRA (Locked In Retirement Account))

- Can only hold cash and stocks in Canadian currency

- Not all stocks are available to buy for example Disney

- No DRIP (Dividend Re-investment Plan)

Transferring to Wealthsimple

Transferring to WS Trade was pretty easy, the transfer only took seven days I was impressed with how quickly it took. When transferring your account you go into the Trade app and go to transfer, you are asked questions such as current value of account, account number and institution where the funds currently are in. Once that is done you are are asked if you want your institution to sell your investments and move the cash to WS Trade, move everything as is (keeping your current holdings) and finally whether you want to sell some assets and keep others. I would say this process takes five mins max.

Once that is complete you will receive an email saying that the transfer process usually takes five weeks. I chose to transfer my account as is meaning I didn’t want anything to change, I believe that is the quicker option and why it only took seven days instead of five weeks.

What About My Other Accounts

If you have been reading my blog for a it then you know that I have four investing accounts TFSA, RRSP (2) and LIRA. I currently have a small RRSP account on the app, I have decided to only move my TFSA account to WS Trade, I am going to leave the other two accounts with RBC Direct Investing. The reason for this is for one LIRA accounts are not yet supported with WS Trade, and if I wanted to move my RRSP account I would have to sell my US stocks and transfer that cash into Canadian money. Once the account was moved I would have to re-buy those stocks again at a higher price which doesn’t make a lot of sense to me.

I’m hoping in the future Wealthsimple will continue to upgrade the Trade app and add more accounts and give users the ability to hold US currency in their accounts.

DRIP

Currently the app does not offer DRIP (Dividend Re-Investment Plans) which is a bummer, however since there are zero commissions investors can invest the money themselves back into that same stock or other stocks they own.

I plan on continuing to drip the following stocks:

- Inter Pipeline (IPL)

- Chorus Aviation (CHR)

- Plaza Retail Reit (PLZ.UN)

- European Residential Reit (ERE.UN)

- Bank of Nova Scotia (BNS)

- Canadian Utilities (CU)

- Transcontinental (TCL)

The BMO International Dividend ETF (ZDI) doesn’t offer a DRIP however with the new platform I will be starting my own.

Experience Using WS Trade

I’ve been using WS Trade now for about a month. I opened an RRSP account in early January so I could buy an ETF. The experience has been very good I must say. I find the app very user friendly, I haven’t experience any real problems using it. For example this happened a couple of times an error would pop up when I tried buying my ETF XAW and said it didn’t go through but as soon as you tried it again it worked just fine. One thing I would like to see in the future is the ability to sign in using a computer, it just feels weird using my phone.

I decided to add some photos for you to give you a bit of the user experience of the app.

So this is your main screen after you sign in it gives you the ability to see account value and you can select to see how the account has done for the last week, month, three months, year and life time. Not seen in the picture you could scroll down and see all of your investments within the account.

So this is the options menu, in the picture above you see the great button above TFSA you just press this to access the menu. Like I said it is pretty user friendly.

If you tapped on a stock you were holding you would come to this screen. It shows how many shares you hold, the weighting the stock has in your portfolio. It also shows your returns and average price per share. This screen is of my Canadian National Railway holding.

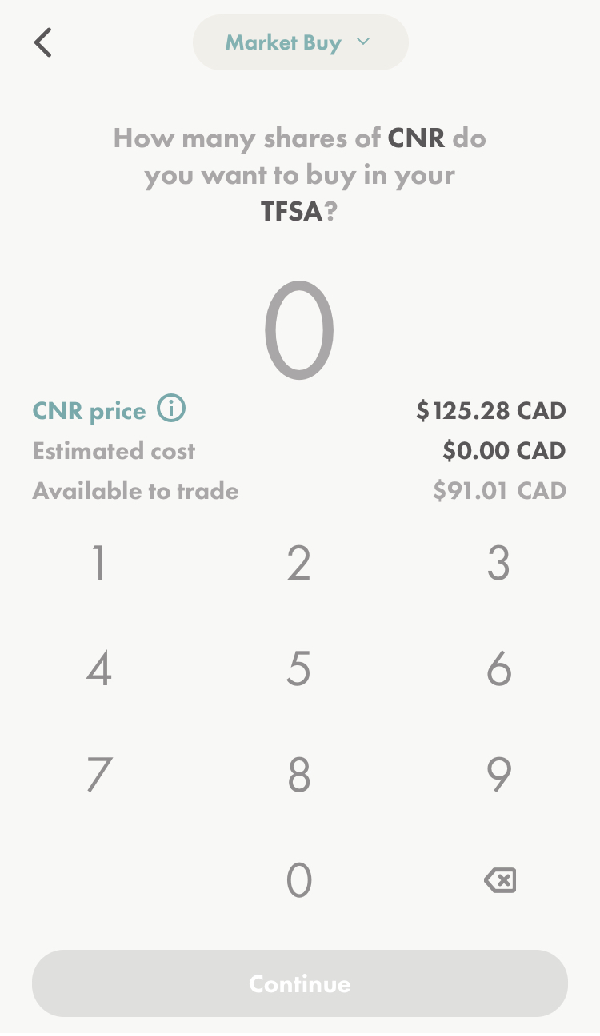

When you want to buy a stock/ETF this is the screen you will see. It will show you the current price of the share and how much money you have in your account.

So what do you think of my decision to move my Tax Free Savings Account? Does Wealthsimple Trade sound like a good option for you?

Thanks for reading!

Matthew

Great recap Matthew. Just curious why you choose Wealthsimple Trade over Questrade as Questrade has some of the features you are hoping WST eventually has.

We have our self directed investments with Questrade and have been very happy there.

Just curious about how you came to your decision.

LikeLiked by 1 person

Hi and thanks. I chose WealthSimple Trade over Questrade because they didn’t have any account minimums and the zero commissions were enticing i can’t remember what Questrade charges.

LikeLike

Considered WealthSimple but the phone app only was the deal breaker for me. I don’t do any financial transactions on my phone.

I chose Questrade because I have never had any problems there and my non-reg is there..

LikeLiked by 1 person

I hear ya I was a little leery at first about using my phone.

LikeLike

Hey Matthew,

Nice coverage on WealthSimple Trade, the app has a nice clean interface.

I have all my accounts (TFSA / RRSP / LIRA) with Questrade and since they have no commissions on ETFs, i’ve stuck with them since I started.

-DGX Capital

LikeLiked by 1 person

Thanks and I agree with you on the Wealthsimple Trade app. I don’t blame you with staying with Questrade since they don’t charge commissions on ETFs I would do the same.

LikeLike

Thanks for sharing Matthew. It’s great to have other options and the no-fee purchases are an incentive for sure. However, no DRIPs are a deal breaker for me. I get you could just reinvest at no cost and it could actually be preferable as you could choose the better buy at the time. As a ‘buy and hold’ dividend investor the 20 or so stocks I hold in my accounts paying dividends quarterly or monthly would involve more effort to manually DRIP than I’d want.

LikeLiked by 1 person

Hey Gord what you say makes complete sense.

LikeLike