Hi friends today I am going to take a little break from talking about investing. I thought I would talk about the credit cards I have, and how I earn money while I spend my money. The idea came to me while I was paying my bill. I use a credit card for every purchase I make. I couldn’t tell you the last time I paid with cash or even carried cash. I have had a credit card since I was 18 years old (16 years ago) the card was like a starter card, I got it at my local bank branch and it had a $500 limit, the card allowed me to build credit and be financially responsible.

Here in Canada there are six large banks that dominate the banking landscape. Royal Bank of Canada is one of them and I have been a client for my entire life (34 years). RBC is where I got my first credit card. After about three or four years I decided I wanted to get a better card and upgrade and thought a rewards card would be perfect. But what to get?? There were so many choices open to me. From the ages 21 to present day (34) I have owned 7 different credit cards, one of them twice. To say I didn’t have a clue as to what I was doing is an understatement.

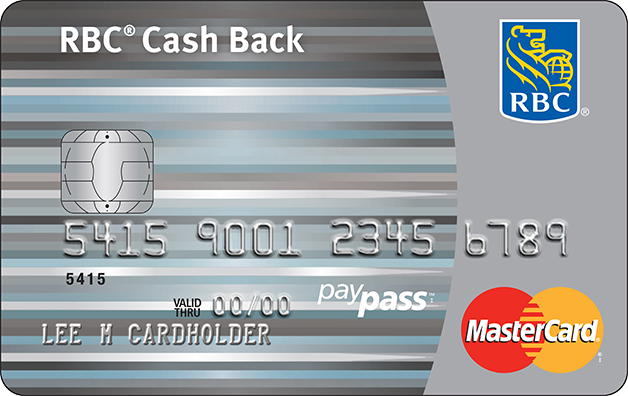

In 2016 I held the RBC Visa Platinum Avion card it allowed me to earn 1 point per dollar spent and came with a $120 annual fee. Early on in 2016 I became dissatisfied with the way I was handling money and found myself spending just for the shake of collecting points. I always paid my bills in full and didn’t go into debt but I found I wasn’t able to put money into savings. I made a decision I wanted to become a saver and not a spender in order for that to happen I needed to change my credit card. So I redeemed my points and went looking for a new card, since I wanted to save money I looked at what my bank had to offer which wasn’t much and I should have looked at what else was out there. What I chose was the RBC Mastercard Cash Back.

Cards I Currently Use

As mentioned above in 2016 I selected the RBC Mastercard Cash Back card to go with my new mindset of becoming a saver. Here are some of the benefits of the card.

- No fee

- Earn 2% cash back on grocery purchases

- Earn 1% on all other puchases

What I liked right away about the card was the no fee. With the Avion card I had I didn’t like paying $120 per year as I didn’t think I was getting the full value out of the card to justify the fee. The cash back also looked attractive since I use my card for everything I figured I would earn a lot of money back. For 2016 I received $31.19 cash back just for using this card. So far in 2017 I have earned $12.84.

In March of this year I was reading blog post from my friend Cait Flanders called Are You Using the Best Financial Products for You? If you haven’t read it go read it, in my opinion it is a great post. In the post the Tangerine Cash Back credit card is mentioned, this is the first I had heard of this card and thought I would check it out. Upon doing research on the card I liked it right off the bat, so I signed up.

Features of the card:

- No fee

- Receive your cash back every month you don’t have to wait till year end to receive it.

- Earn 2% cash back in two spending categories (your choice), a third if you open a savings account and link it to your card to deposit the cash back you receive.

- Earn 0.5% on all other purchases.

After doing my homework I thought this card would be perfect for me. With this card I could earn 2% back in two categories of my choice, a third if I opened a savings account and linked it to the card. I decided to go ahead and open the account and received a third category. Since my other credit card offered me 2% in groceries I did not select that for the new card, instead my three selections were restaurants, gas stations and recurring bills. Also Tangerine allows you to change categories after you make your picks.

I must admit I am a little disappointed that you can only earn 0.5% on other purchases outside of my three categories. When I signed up it was 1%, shortly after I received a notice that it was being lowered.

Since getting this card in March I have earned $47.68 cash back. On average I am earning $6.81 not a huge amount but it will all add up, each month the money I have earned gets deposited into my account. I wish I had heard of this card before I absolutely love it. Lol didn’t think I would ever love a credit card 🙂 So far this year when I combine both of my cards I have earned $60.52 back.

Why Two Mastercards?

Some of you may ask why have two Mastercards? I have chosen to keep my first card because it doesn’t cost me anything with no fee. Also With both cards combined I can earn 2% cash back in four categories which helps boost my savings. I call that a win-win.

I am very happy with these cards and wish I had gone with cash back cards sooner. I feel that having these cards is a big money win for me. I would recommend them to anyone looking for a cash back card. What are your thoughts on these cards? Please let me know.

So are you looking for a new credit card? Do you like your current card? What card or cards do you use? Please feel free to share in the comment section, I would like to know what everyone else is using.

Thanks for reading

Matthew

Super smart to replace the credit cards with annual fees for ones without. Even though the Tangerine card offers .5% back for most purchases, it seems like you have your major bases covered between your two cards. The best cashback card I have is 1.5% and I try to put everything on it to get the cash back! (Without over spending, of course, and paying it off every month.)

LikeLiked by 1 person

Thanks Jax good job getting that cash back. The key is not to over spend 🙂 thanks for stopping by.

LikeLike

Great post Matthew. Do you also bank with Tangerine? I’m with PC right now but was considering switching to Tangerine because of the shift to the new CIBC Simplii platform that’s taking over for PC. The Tangerine credit card sounds pretty great.

LikeLiked by 1 person

Hi Sarah I only have a savings account which I use to deposit my cash back, and the credit card. Oh that’s right PC and CIBC are doing that shift. I love the Tangerine credit card in seven months I have earned more money back than I did all of last year. If you are going to switch to Tangerine please let me I can give you an Orange key and if you deposit a minimum of $100 we each get $50 free. 🙂

LikeLike

My friends love their Tangerine card. I don’t have one. My favourite no fee card is the MasterCard World Elite MBNA- it gives 2% cash back- it is free for me but I think it might be $89 annual fee now. PC Financial World Elite MasterCard is also good, we’ve gotten $400 in groceries redeemed this year already. I have two MC’s too! 🙂

LikeLiked by 1 person

Sounds like you have a couple of cards that work well for you that is good to hear 👍.

LikeLike

I personally use the Rogers bank platinum master card. Because I am a Rogers customer, my $29 annual fee is waived. This card gives you a 1.75% reward on your purchase across the board. Now, I earn at least that much on every purchase. Check it out.

LikeLiked by 1 person

Thanks Leo sounds like a good card.

LikeLike

Im all about that Cash Back life! I wrote on it recently, but its hard to get through to some people who feel like credit cards are evil lol. Great article!

LikeLiked by 1 person

Thanks Gabe I will check out your post 👍

LikeLike

I have a Scotia Momentum Visa. There is a fee of $99 but you get 4% on groceries and gas, 2% at Drug Stores and 1% on everything else. I’ve made over $500 on this card so far this year. My backup card is a Capital One Aspire Cash which is free and gives me 1.5%. My YTD cash back on that card is around $200. I had a Tangerine as I liked the 2% on selected categories. But earlier this year the card was compromised and it took 3 months and literally 12 phone calls to sort it out. When this sort of thing has happened to me with other cards in the past, it has been sorted out with one phone call. I will not tolerate poor customer service so got rid of the Tangerine card.

LikeLiked by 1 person

Thanks Ed I like your two cards. Sorry to hear about the poor customer service you received from a Tangerine.

LikeLike